Financial Advisors and 401(k) Plan Fiduciaries have been long obligated to explain or justify their fees, based on the scope of their services, the quality and the value they deliver to 401(k) plan clients. Сertain aspects of benchmarking are “non-negotiable” as Plan Fiduciaries are required to ensure that they are paying only reasonable plan expenses. There has been and will continue to be, heightened scrutiny on plan fees. Like most fees, there’s more to it than just the price.

Conducting 401k plan fee benchmarking should be important to every Plan Fiduciary and Retirement Committee Member. The findings and the resulting savings can be substantial – 401kTV once again outlines the importance of the 401(k) plan fee benchmarking in their short interview here.

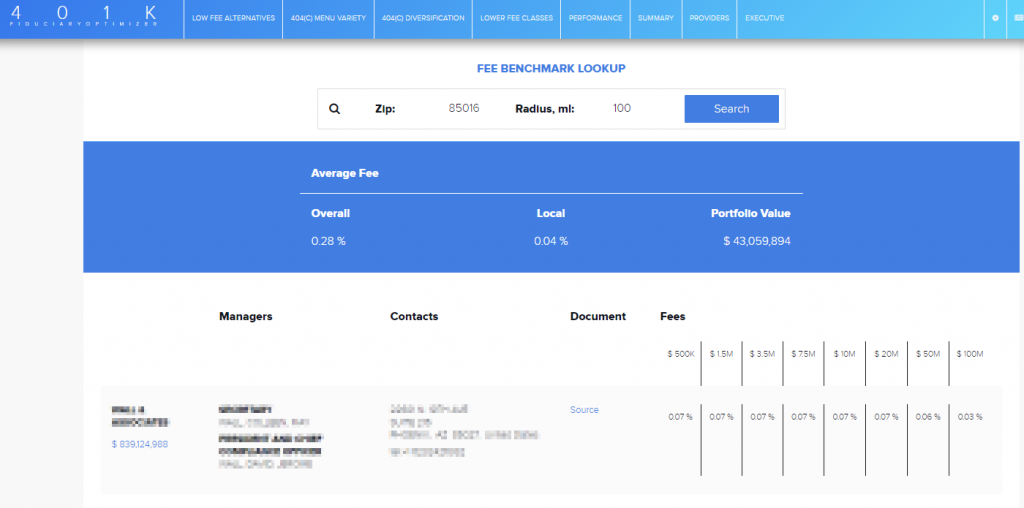

401kFiduciaryOptimizer has a built-in database of advisory fees called FeeComp which provides advisors with a certain level of confidence while making a reasonable fee decision:

It is based on SEC form ADV data. Larkspur-Rixtrema has solved the main problem with that form where the fees are reported in Part 2, which essentially is a free-form essay without a set structure and very hard to read on its own. Through a combination of new technologies and our extensive statistical knowledge we were able to solve the issue and provide a clear and easy to use solution. All of our 401kFiduciaryOptimizer clients are able to compare their fees to other advisors in a similar region, with similar clients, offering similar services.

Pingback : Case Study: How to Use Comparisons to Alert Complacent Plan Sponsors