Like an MRI machine for a doctor, the Low Fee Alternative report allows an advisor to diagnose problems within a plan. For example, it can identify closet index funds in a plan that is paying for an expensive actively managed fund that is quantitively similar to index funds.

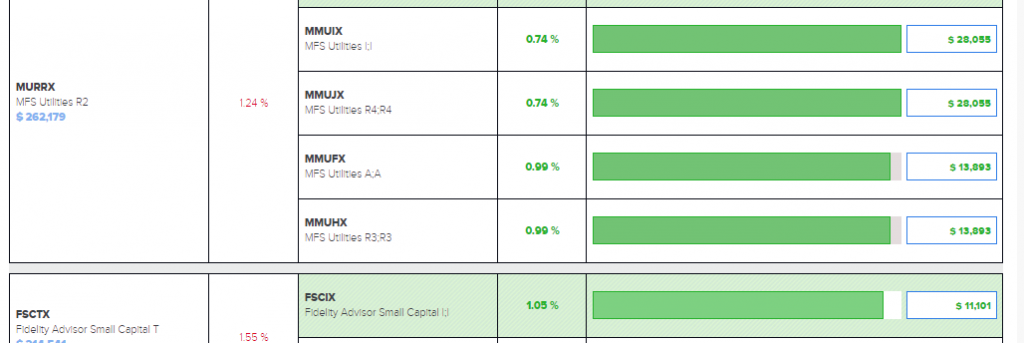

A show of savings switching from one share class to another with a few funds as an example

One of the pillars of fiduciary rule is to provide a client with the best possible advice about the investment. When it comes down to picking the best share class of the fund, it is worth to take a look at all available share classes to pick the best one that will suit the needs of the client. In most cases, the performance of different share classes of the same fund family would be similar to each other. However, the biggest advantage that an advisor can offer to a client is through the savings that can be generated by picking the least expensive share class. Moreover, as a fiduciary it is a direct responsibility of the advisor and plan sponsor to look for the least expensive share class to offer to clients and participants. The Low Fee Classes report helps you immediately identify if there are more affordable share classes available. Knowing such information ahead of the meeting will help the advisor to point out the deficiency of the plan and facilitate the conversation with the plan sponsor on how to correct it.

Request your personal tour of all 401kFiduciaryOptimizer features here:

Pingback : Your 1 minute case study on 401K Retirement Plans: A huge potential to save

Pingback : 7 Exclusive Case Studies on 401K Retirement Plans for Financial Advisors