If you are a plan fiduciary, then under the Employee Retirement Income Security Act of 1974 (ERISA), fiduciaries can be held personally liable for losses to a benefit plan incurred as a result of their alleged errors or omissions or breach of their fiduciary duties. It is a tough law aimed to make plan fiduciaries responsible for the advice they give because the financial assets affected by their advice will effect a lot of people. The money is for the people who work hard and save money to enjoy the fruits of their labor when they retire. So, you must be diligent and prudent in the advice you provide for the sake of other people as well as yourself.

Plan fiduciaries should do their best to avoid fiduciary liability by following and taking into account the following:

- Setting up a prudent process to select, evaluate and actively monitor plan investments. This process must be carefully documented to show that the internal systematic approach exists within the firm to deal with the menu selection.

- The cost of available investment options must be compared to select the most cost efficient ones, especially among the family of the funds. For example, when choosing between retail versus institutional share classes for a retirement plan.

- Keeping plan associated costs like recordkeeping under control by continuously surveying the market for better providers and comparing them to find the most beneficial one.

- Fully disclosing service providers’ compensation to participants to keep them aware who pays for the plan.

- Continuously monitoring the plan to evaluate its menu expense fees, performance, diversification and service providers’ cost.

- Exploring the options to protect plan fiduciaries against fiduciary liability.

These are general guidelines provided by ERISA to follow by plan fiduciaries to avoid any unpleasant surprises in their practice when working with retirement plans. To successfully avoid any litigation and not to fall prey to any lawsuits, it is of a paramount importance to make sure that the necessary infrastructure and tools are in place when conducting any retirement plan business. This is because there are a lot people now looking at the retirement plans trying to find any reason to start a class action. A recent example is the well-known Tibble vs. Edison case. In this case, Judge Stephen V. Wilson of the U.S. District Court for the Central District of California has ruled for plaintiffs, where the plaintiffs claimed that executives of an Edison International Inc. 401(k) plan breached their fiduciary duties by selecting more-expensive retail-priced shares versus institutionally priced shares for identical investment options.

Of course, the institutional share class is not an answer to all questions or suitable for all plans. But the main takeaway for every advisor from this lawsuit is to be very diligent about how to advise on what funds should be on the menu of the retirement plan. It is necessary to have a screening process that would go through all the funds available to the plan sponsor based on either the provider platform they are using or an alternative platform. An alternative platform should be considered if it can benefit the plan sponsor and plan participants if they would switch to more cost efficient alternatives available on that platform.

Another important point about Tibble vs. Edison is how swiftly an adviser must make a recommendation about the low fee alternative funds, especially low fee share classes. Waiting for the next quarterly review to make a recommendation to change a share class is no longer prudent given that plan fiduciary was aware that a lower fee share class would provide similar investment opportunities to plan participants but at the lower cost.

Here, at RiXtrema, we put a lot of effort researching the fiduciary world to come up with the optimal solution that can help advisers to stay on the top of things in a quickly changing regulatory environment under the new Department of Labor rule. The 401k Fiduciary Optimizer tool allows the adviser to carefully scan through all available options loaded from a provider list to find highly similar funds, using quantitative algorithms, with the lowest expense ratio and better performance. This easy to use software would optimize the existing menu and show the aggregate savings that can be generated by the low fee alternative funds. Moreover, lower fee fund selection is also based on finding funds with better historical performance.

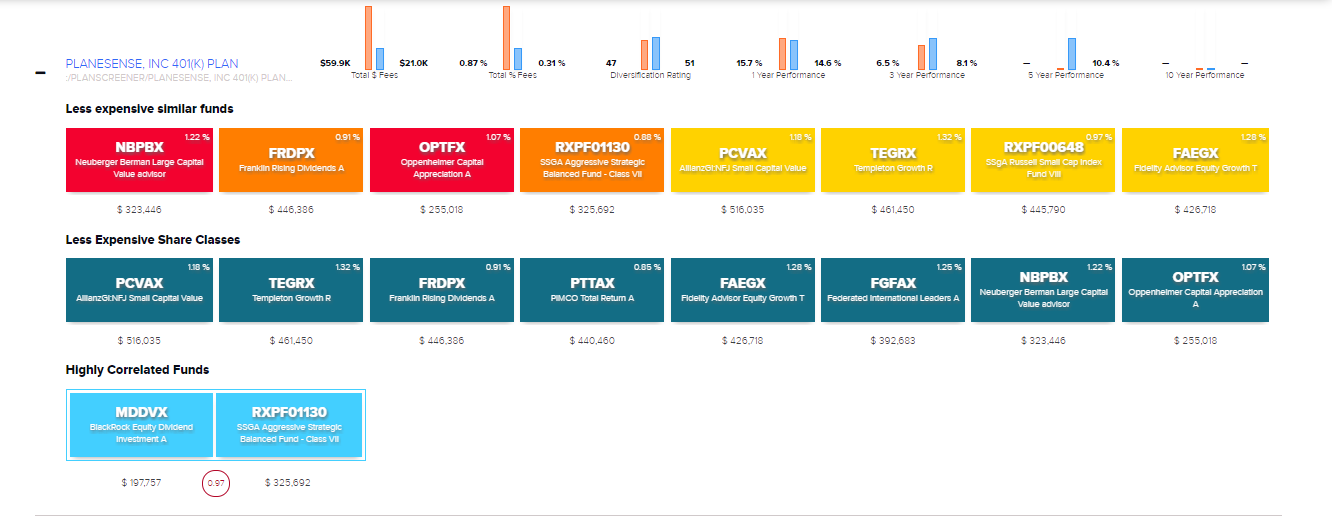

Plan Monitor, which is part of the 401k Fiduciary Optimizer, would provide the advisor with the dashboard to keep track of the health of their existing clients’ retirement plans by notifying them if any immediate action is necessary to avoid a fiduciary breach. It provides three areas to monitor which are Less Expensive Similar Funds, Less Expensive Share Classes and Highly Correlated Funds. For example, knowing that less expensive share classes are available and being quickly able to discuss it with the plan sponsor makes a plan fiduciary prudent in his/her effort to act in the best interest of the client. Moreover, Plan Monitor creates a process that documents all steps undertaken to fulfil the fiduciary duty to the client by keeping track of recommendations, actions taken to enhance the menu, results provided based on the advice.

Figure 1. Screenshot of Plan Monitor

These days a digital tool like Plan Monitor is a necessity, to be helpful to the plan sponsor and plan participants, in order to fulfill a fiduciary role. It is also important for a plan fiduciary to know that the detailed and prudent process of screening and monitoring the retirement plans will protect his/her assets from fiduciary liability in case there is a lawsuit.

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for May 2018

Pingback : How to distinguish yourself from the competition as a plan advisor

Pingback : ERISA fiduciary insurance and the importance of protecting fiduciaries from liability

Pingback : What are the Best Ways to Avoid a 401K Fiduciary Lawsuit?