Target Date Funds or TDFs, became a big part of the retirement process. At this point, TDFs represent around 20% of all 401(k) plan assets and approximately 50% of all new 401(k) contributions are directed into TDFs. There are different reasons why TDFs are so popular among the retirement professionals and participants, and why it is a new trend in the retirement business.

It is easy to understand what a TDF fund is, for both, retirement professionals and participants. For example, Fidelity Freedom® 2035 Fund (FFTHX) by its name points out that it is a suitable fund to invest for people who plan to retire around that date. However, there are different features related to TDFs which must be considered before making a decision to invest in one. For example, an investor must understand a “glide path” of the fund. Since a TDF fund is a mix of different assets like equity, bonds, cash, etc., the time period during which the investment mix gradually changes is referred to as the “glide path”. Also, there are different approaches in the “glide path”. When asset mix becomes conservative before the target date, this approach is called “to”. Whereas if asset mix becomes conservative years after, the target date, such approach is called “through”. The later approach can be used by participants who do not plan to withdraw all the money from 401(k) right after they retire but plan to do it gradually because asset mix still has enough exposure to equities rather than predominately to fixed income as with the “to” approach.

As a fiduciary to a plan sponsor, advisor who looks into TDFs must adhere to guidelines set forth by the Department of Labor when it comes down to fiduciary responsibilities. First of all, a process of comparing and selecting TDFs must be in place to evaluate the prudence of any investment option made available under the plan. Secondly, the advisor must establish a process for the periodic review of selected TDFs to ensure that these funds should continue to offer. Thirdly, the advisor must understand TDF’s “glide path” and their approach to target date. And finally, the advisor should review TDFs fees and expenses in order to make the best recommendation.

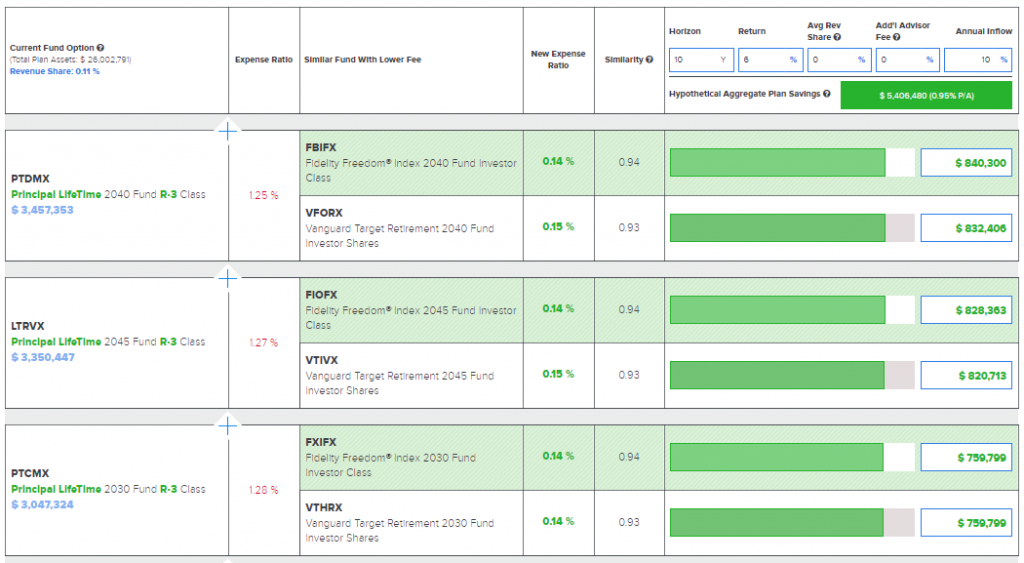

In the 401kFiduciaryOptimizer, a user can start searching for the best Target Date Fund family by loading a plan of the plan sponsor and searching for other available but more cost efficient options. For example, after I loaded a plan which as its QDIA has Principle LifeTime TDFs. I compared them to other similar TDFs and found a few alternative options which are less expensive and have better performance. If I pick Fidelity Freedom funds as a better alternative for my plan, then switching from Principal LifeTime 2040 (PTDMX) to Fidelity Freedom Index 2040 (FBIFX), my aggregate savings over next 10 years will be $840,300 assuming rate of return on the investment is 6%. Now imagine the amount of savings that can be produced if the entire TDF family is replaced with more efficient funds.

Request your own free demo of 401kFiduciaryOptimizer below:

Pingback : Why is QDIA Important?