The Ask

Our client specializes in cutting out excess fees in retirement plans, so their ideal prospect is one that is paying too much for their current plan. They need to be able to easily identify plans that are paying a high cost for their size, so how can they identify how much is too much?

The Problem

Identifying plans with high-costs can be difficult since there are so many different variables that can go into a plan’s cost. There’s the money they pay for record-keepers, advisors, and even expenses paid on the actual funds participants are investing into. Prospective plan advisors need a tool that can effectively gauge how much a plan is paying out to all of these different factors to get a complete view on the plan expense. How can an advisor not only make this analysis on a plan but easily locate plans that fall into the category of “high-cost” without wasting all of their time slowly checking the admin fees of each plan (not to mention checking the fund management costs)?

The Solution

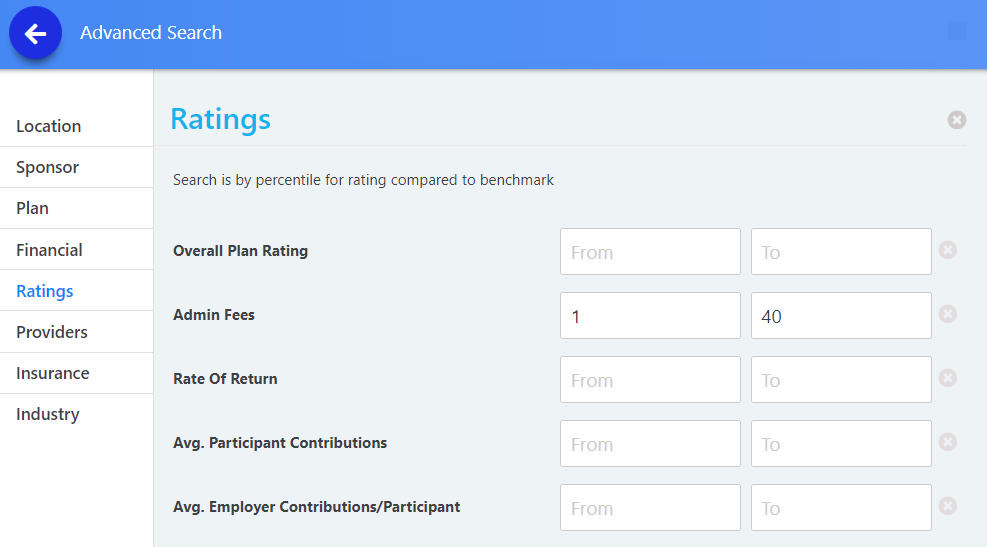

With our new Larkspur Executive tool, there is now a streamlined and sophisticated solution to this problem. Using our benchmark rating system, we rate every plan on a scale of 1 to 100 on several criteria, including their admin fees. Plan’s that fall at a 50 in our rating system means they are square in the middle of their benchmark (which is similar sized plans across the country). Because of this we can easily search for plans that fall below the median to find the poor performers, i.e. high admin fees.

(Figure 1): Searching by “Admin Fees” rating of 1 to 40 to find plans that are below the benchmark median

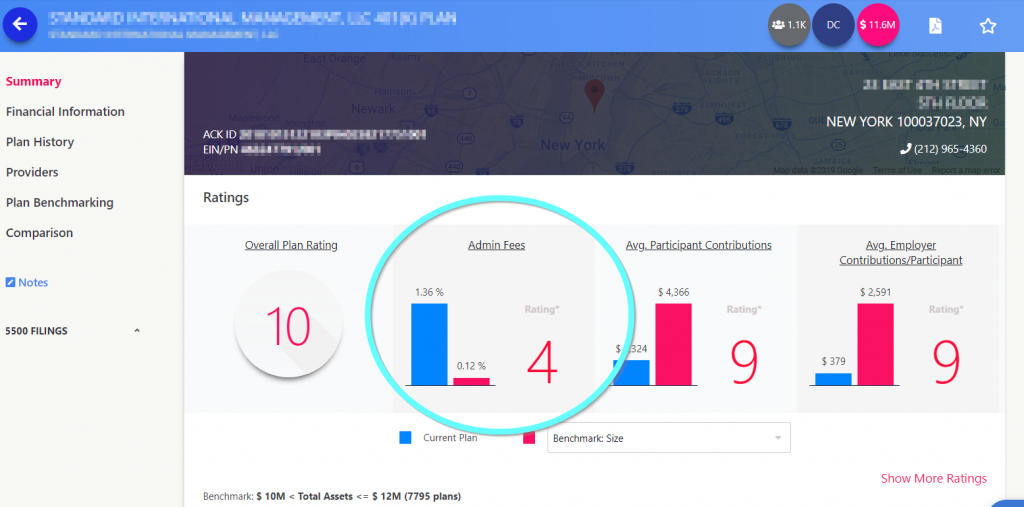

After locating a plan in the Larkspur Executive, we can assess their fees using a couple of different methods. Firstly, we can check how their admin fees stack up against their benchmark by directly comparing what they pay against the median for similar sized plans.

(Figure 2) Admin Fees of 1.36% give this plan a rating of 4 out of 100

In this case (Figure 2), we can see this plan is paying significantly above the median (they have 1.36% admin fees compared to the 0.12% benchmark median!). So not only can we see how much they are paying, but also how much more it is than the rest of their peers. Find out more about our plan benchmarking tools here.

On top of analyzing the admin fees, we also have a full breakdown of the fund investments on many plans, including the funds’ expense ratios. We even have a critical piece of info that we call the “Aggregate Plan Savings.” This figure is how much money this plan could save over 10 years if they switched their investment options over to nearly identical, but cheaper alternative funds. This is a great analysis on how inefficient and overpriced their current fund menu may be.

Pingback : Plan Ratings in Larkspur Executive -