- Adjust to your clients’ communication platform

- Get back to the basics

- Be selective with who your client is.

- Make it truly personal

- Be well aware of your clients’ best interests

- Communicate with Clients even when you’re not around

In our modern world, there are tons of ways to keep up with your clients and even prospects, and we’ve thought up a few ways below for you to keep in mind. Whether it’s their preferred means of communication or what you should be talking about with them, we hope you’ll find some of our strategies below useful:

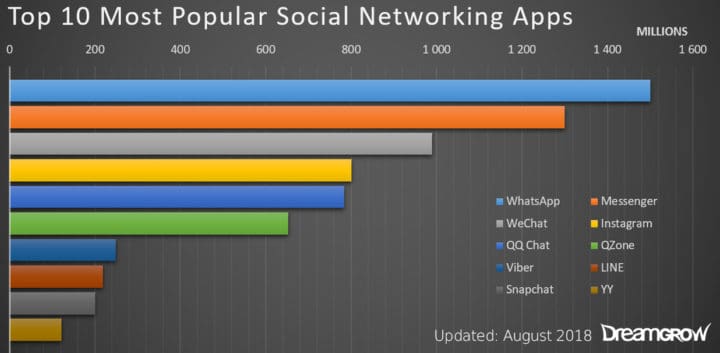

Adjust to your clients’ communication platform

You may prefer a phone call, but your client might just want a quick text message to get to the point of the conversation. Always ask if this is the preferred method of communication for your client. Here are some stats on the top communication apps to keep in mind:

By using the communication platform your client prefers you are not only increasing your chances of being heard but also demonstrating your tech versatility and the ability to adjust to your client’s needs. This could be crucial in the long run in terms of building trust and credibility.

Get back to the basics

When sitting face-to-face, remember the basics of good communication:

- Maintain good eye contact and speak clearly at a level your clients will understand.

- Don’t use technical jargon.

- Keep things as simple as possible – don’t use two words when one will suffice.

- Once you said your piece ask if your listeners understood you correctly – what they hear may not be the same as what you’re saying.

- If clients look glazed over, try again.

And of course remember to listen more than you talk. Only by listening intently to your clients will you get to the bottom of what they really want. Plus, people find it flattering when others want to listen to them. Finally, analogies are a good way to communicate the nature of market volatility while vision stories are great at communicating the rewards of investing.

Be selective with who your client is.

When it comes to advising how to grow your business there will be a ton of literature on how to do it fast. Most of it will ignore the human factor, instead focusing on the number of clients, leads, prospects, etc. However, the human factor should be a primary focus when you building your business you want to last for your lifetime. It is more productive (more AUM) and more efficient (more is done with less time) to work with people with whom you have connection, respect, and mutual understanding. This kind of client-base does not have to be restricted by a narrow niche, but rather can include people from different fields. As long as you have a common interest that makes your cooperation a productive endeavor, your niche can be as wide as the world.

Make it truly personal

Monthly newsletters oriented purely around professional topics, no matter how well-written or insightful, are cold and impersonal to many clients. What’s more, this information can be found almost anywhere. Instead, focus on making connections in unexpected, more personal ways. For example, while most advisors already send out holiday and birthday cards, they forget about other important days. I recently worked with an advisor team that one year sent their BBQ-enthusiast clients a high-end barbeque sauce in advance of the July 4 holiday weekend. Another advisor reached out on Arbor Day to clients who enjoyed the outdoors and nature, giving them seeds to plant a tree. In each case, the response was overwhelming, because the gestures were thoughtful, heartfelt and unexpected. Source

Be well aware of your clients’ best interests

Whether your client is a CFO in a big company running a 401(k) plan or a person planning to rollover into an individual retirement account, it’s always worth checking what material you have to work with in the first place. Their portfolio is what you may need to analyze first, even before your first meeting. First check all their investment options in the portfolio, analyse them in terms of performance and cost-efficiency, estimate the risks, and create a strategy for improving it. Being well prepared is a key point for your confidence, and trustworthiness. Nothing works better than a firm argument based on solid facts and accurate calculations. All of this will make your clients more inclined to follow your advice and ask you for further assistance in the future.

Communicate with Clients even when you’re not around

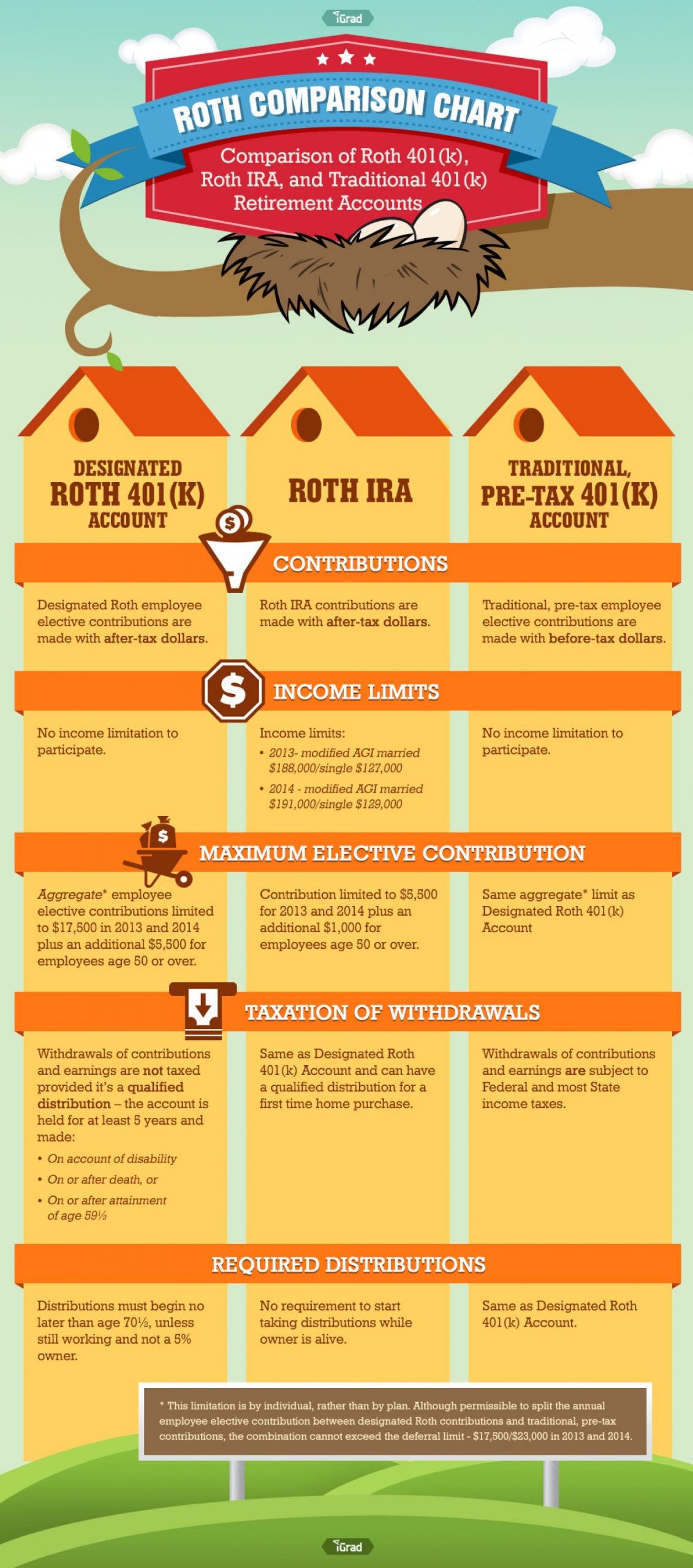

Even if it’s not the most personal method, online content still provides a great opportunity for you to speak to your clients constantly even when you are not available in person or online. The forms of communication can vary but here are some useful examples to keep in mind:

Source: https://visual.ly/community/infographic/economy/roth-comparison-chart

Notice that this infographic is giving more than it is asking, in addition to being simple and easy to understand. Once a person knows more about the need to have a retirement plan then they will refer back to you for more advice and a proper investing direction. And of course, don’t forget about videos as video clips are shared 12 times more often on social media than simple text and links alone(source). Here’s one creative example depicting a day in the life a financial advisor:

No matter what method you choose to keep in touch with your clients, it’s important that you are catering to them above all else. You should be flexible and easy to reach, while also proactive with them. Maintaining priorities and staying on top of our “always online” world is critical for financial advisors in in the 21st century.