The Story that Never Gets Old

401(k) litigation has been on going for nearly ten years and now lawyers began to vigorously extend it over to 403(b) plans. Top national educational institutions are in need of educating themselves to withstand litigation and defend themselves in court. Recent years have brought more than a dozen class-action lawsuits which are being filed for alleging fiduciary breaches in the management of 403(b) retirement plans of leading universities. MIT, Duke, Yale, Columbia, Cornell, Emory, J.Hopkins, UPenn, Vanderbilt, Northwestern, and we still see more incoming – this year started with a trial of New York University 403(b) participants filing a suit against excessive fees and multiple record-keepers in the plan. The same story continues to repeat itself – where more and more large universities are being sued with the pace of lawsuits only increasing.

Financial Institutions, religious organizations, and hospitals are also being targeted for excessive fees for 401(k) plans and underfunded defined benefit plans. What about your 403(b)?

What 403(b) and 401(k) Litigations Have In Common

Suits against fiduciaries of 403(b) plans are a major development and may signal the beginning of a whole new phase in fee litigation. As you know, 403(b) plans, like 401(k) plans, permit employees to make pre-tax contributions, but only tax-exempt employers may sponsor 403(b) plans. Although Section 403(b) has been in the Internal Revenue Code for a long time and many (but not all) 403(b) plans are subject to ERISA, 403(b) plans have not traditionally received much attention from the Department of Labor. Many are in “set it and forget it” mode and their governance policies haven’t been updated to reflect fiduciary best practice. Most of the lawsuits being filed share the same fiduciary oversight of fees paid by plans and the process for selecting/retaining service providers. Let’s have a quick recap on some of the most recurrent claims.

1. Failure to Maintain Reasonable Recordkeeping Fees

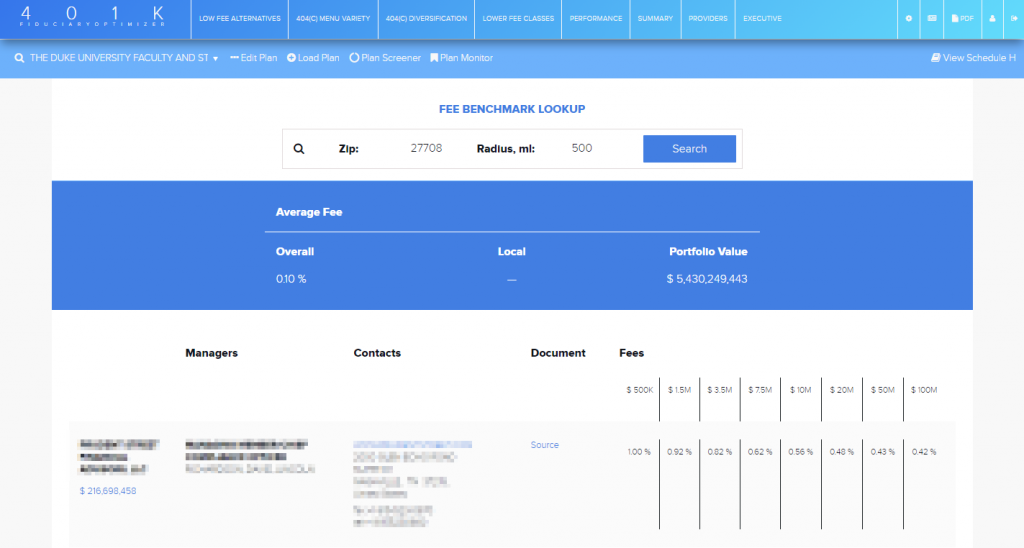

This is by far the number one claim on the list, raised by almost every large university mentioned. It entails that the defendants failed to prudently monitor and control the compensation received by the plan’s record keepers to ensure that the plan only paid reasonable fees for recordkeeping and administrative services. Lawsuits also raise questions about the disconnect between revenue sharing (generated by asset growth) and cost of plan administration. Plan fees should be benchmarked on a regular basis to ensure that they remain competitive compared to similar plans.

Fig.1. RiXtrema Fee benchmarking tool helps advisers monitor 401k plan fees

2. Multiple Record Keepers Used

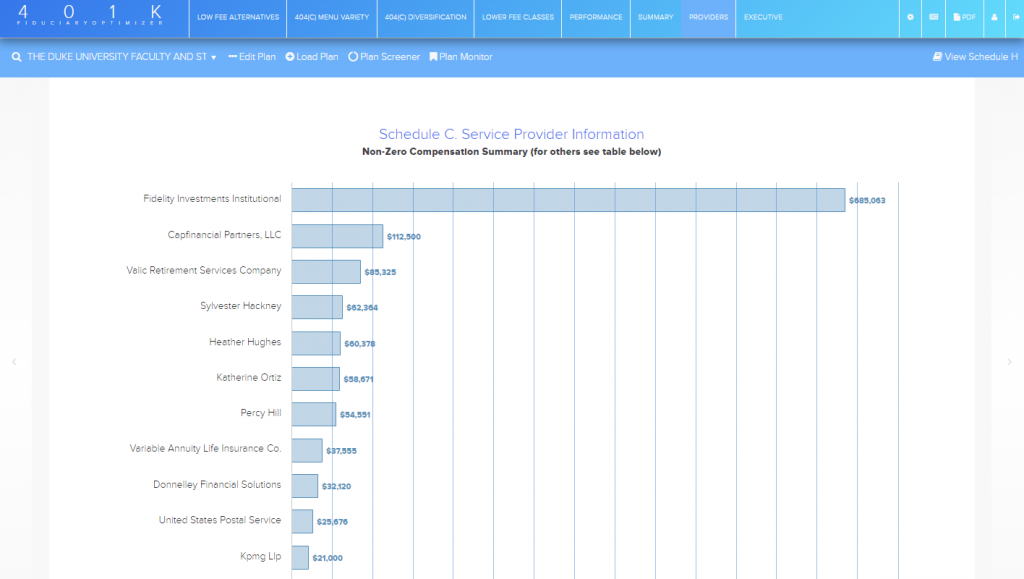

NYU, Duke, Vanderbilt and others were forced to defend themselves against multiple record-keepers employment. This practice undermines the plan’s ability to both negotiate favorable fee terms and streamline the plan’s administrative services.

The plaintiffs allege that the universities should have engaged in more regular competitive bidding for recordkeeping services, employing a single recordkeeper. and recordkeeping fees should have been negotiated on a per participant basis, as opposed to fees paid based on revenue sharing that increase as plan assets increase.

Since there is no specific ERISA restriction to have multiple record keepers, each plan sponsor must examine whether the use of multiple record keepers is justified in their particular situation. This analysis should include reviewing industry best practices, considering both direct and indirect costs and services under a sole provider scenario, and comparing multiple versus single record keeper arrangements.

Fig.2. Reviewing cost break-down structure is made easy in Providers report in 401kFiduciaryOptimizer.

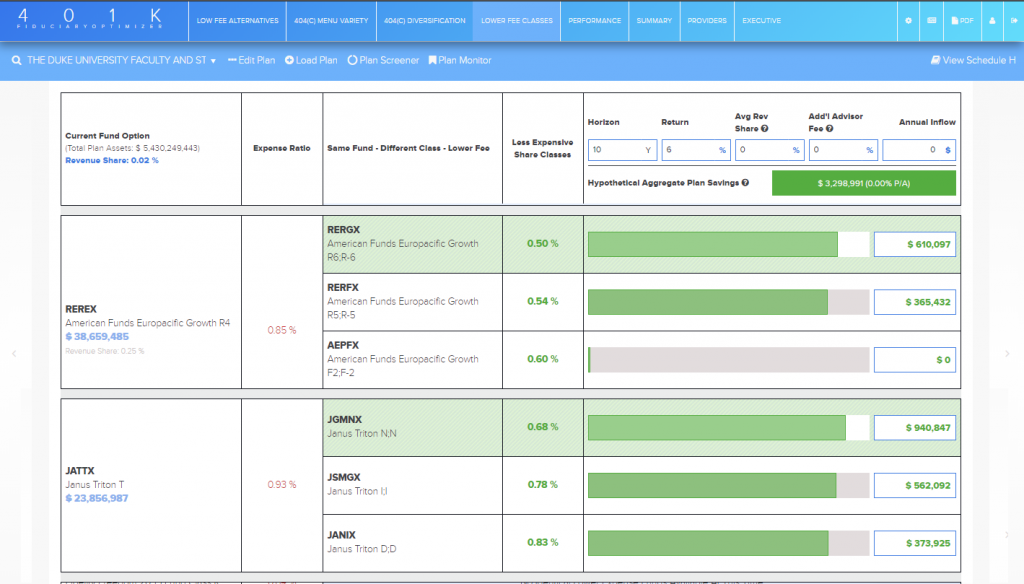

3. Inappropriate Funds and Share Classes Offered

Many lawsuits allege that the defendants failed to prudently consider or offer dramatically lower-cost investments that were available to the plans, including identical mutual funds in lower-cost share classes.

ERISA’s “prudent man” rule requires the use of funds with reasonable fees for the services provided. For an institution to know that fees are reasonable for services offered, it is imperative to be aware of all of the share classes available for a particular fund to a particular client. They also must regularly (not just once a year or 2-3 months) monitor the available share classes, given that over time, investment managers tend to offer additional share classes. It is essential to document the monitoring of available share classes in the search reports utilized in the fund selection process in case of a lawsuit.

Fig.3. RiXtrema’s 401kFiduciaryOptimizer helps to monitor and document the appropriateness of share classes used in the funds menu.

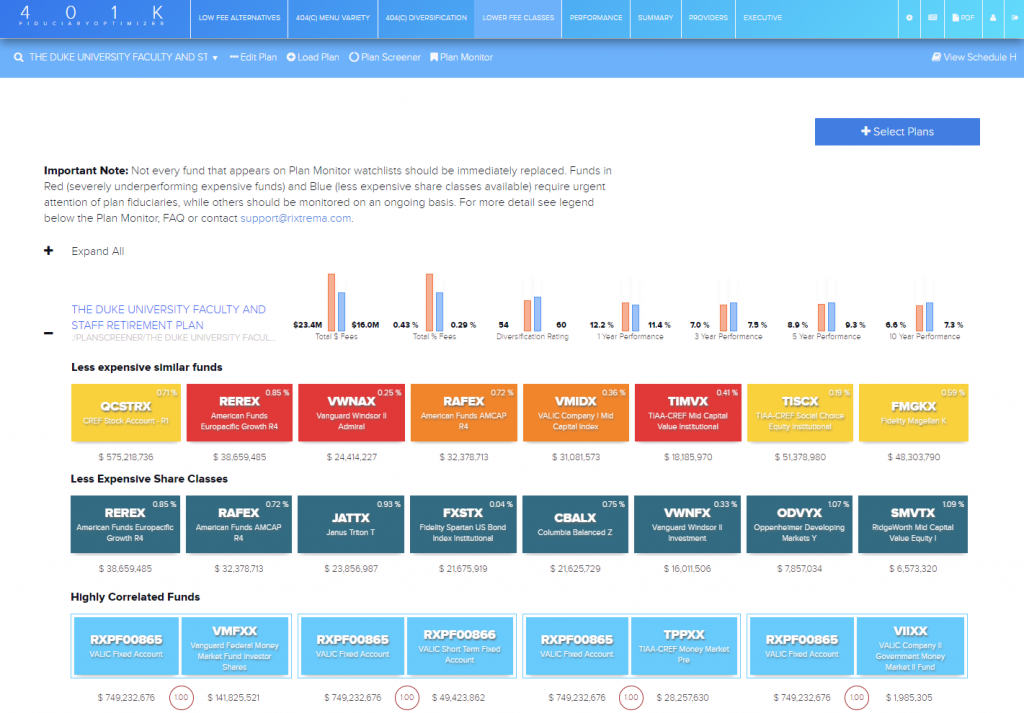

4. Failure to Monitor Fund Performance and Take Appropriate Action

Duke and Emory have been accused of imprudently retaining historically underperforming plan investments. The complaints allege that the universities failed to prudently monitor investment options and remove high-fee and poorly-performing investment products, and failed to consider investments in lower-cost share classes.

To stay “prudent” and act as a Plan Fiduciary, a documented process to monitor designated investment options should be established on an ongoing basis. Any underperforming funds should be promptly replaced. Failure to act on constantly underperforming funds is no different than not monitoring funds in the first place.

Consider different plan design options and regularly review plan investment fees and expenses for reasonableness and value provided, and document the decision to retain or change funds.

Fig.4. RiXtrema’s Plan Monitor helps to establish an ongoing process of monitoring plan menu for performance and less expensive share classes availability as well as plan’s diversification assessment.

Summary

Whether or not a new law is made due to these lawsuits as it was with the Supreme Court decision in Tibble vs Edison (Reasons Quarterly Review is Not Enough After Tibble vs Edison) setting forth an ongoing duty to monitor investments, we have every reason to believe that a wave of litigation against 401(k) and 403(b) plans will go on increasing. If you are the one who is in charge of making decisions about retirement plans investment and management, you should ask yourself a couple of very important questions:

- When was the last time you reviewed your plan expenses?

- Have you developed and are you following a process to review your plan regularly?

If any of these questions give you a hard time answering them, then your plan is in litigation reticle.

RiXtrema developed 401kFiduciaryOptimizer to support retirement plan fiduciaries in their ongoing process for plan reviews and help lower Plan Fiduciary Risk at all costs. Click on the Request Demo below and see for yourself.