Portfolio Crash Testing (PCT) is different from all other stress testing systems (including those available to institutions) for numerous reasons. Our experts at Larkspur-Rixtrema, have put together a detailed list of benefits of the software which will help you explain and manage portfolio risk for any prospect or client:

1. Portfolio Crash Testing (PCT) is a stress testing tool developed by RiXtrema based on its Riskostat software used by large asset managers. (Federal Reserve Stress Scenarios Modeled In Riskostat) It enables financial professionals to understand how their portfolios are likely to behave in a variety of macroeconomic scenarios. The results are presented without statistical jargon and can be used for discussions with prospects and clients with any level of sophistication.

2. For PCT, a unique way to estimate crisis correlations to produce more realistic results is used. This method is based on extensive scientific research and practical work experience of the Larkspur-RiXtrema risk team.

3. Larkspur-RiXtrema’s stress testing algorithms are created to be exceptionally fast. This makes it the only system that can calculate large numbers of stress tests for portfolios of any size and send the results on demand anywhere (risk API) faster than any other system.

4. PCT is also different from all tools available to advisors, because it is the only risk system that passed the scrutiny of large asset managers and is used by those firms on a daily basis on a global scale.

5. Portfolio Crash Testing is FINRA approved to use client facing.

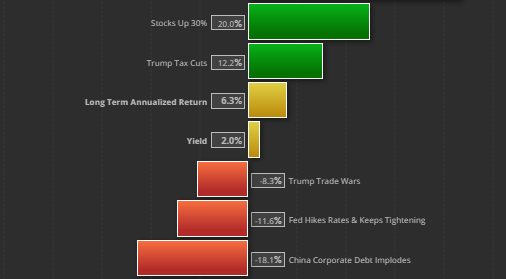

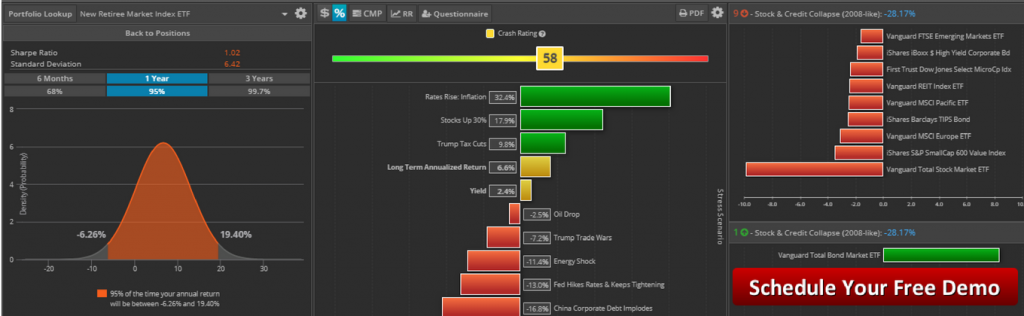

6. It helps clients to conceptualize the risk of their portfolio by visually demonstrating how the portfolio is likely to perform in the future if different scenarios occur. A client tends to understand “a 9% loss during a Trump Trade War” rather than “you have a moderately high risk score”. (See image 2)

Image 2

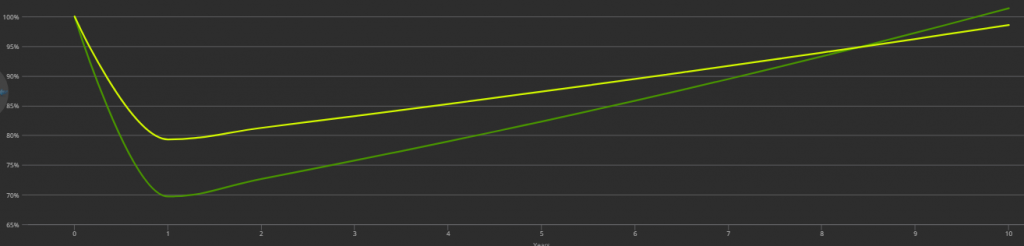

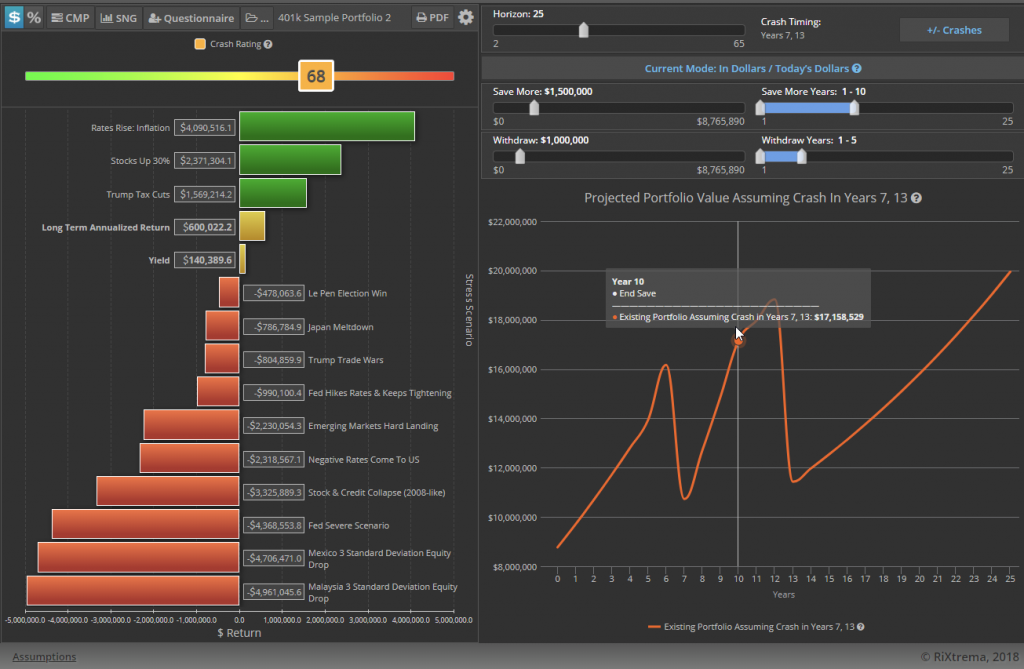

7. Over a client’s investment horizon, you can compare how different portfolios growth and how they are effected differently by simulating crashes. (Image 3)

Image 3

8. Researchers behind Portfolio Crash Testing also won the prestigious Peter L. Bernstein award for Top Article across all Institutional Investor Journals.

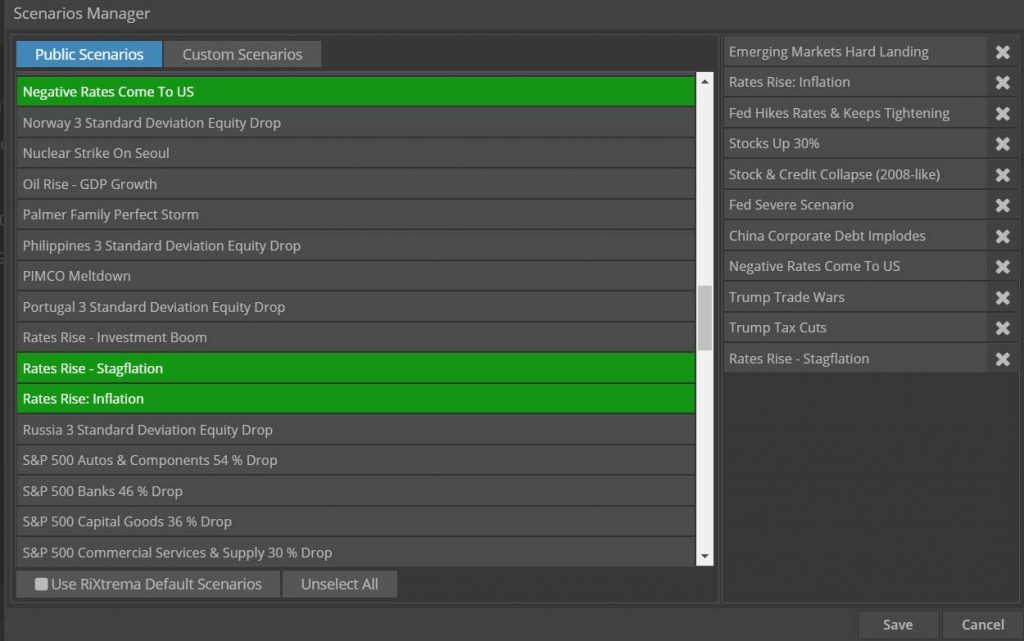

9. Portfolio Crash Test has over 100 different scenarios to stress test a portfolio against. (Image 4)

Image 4

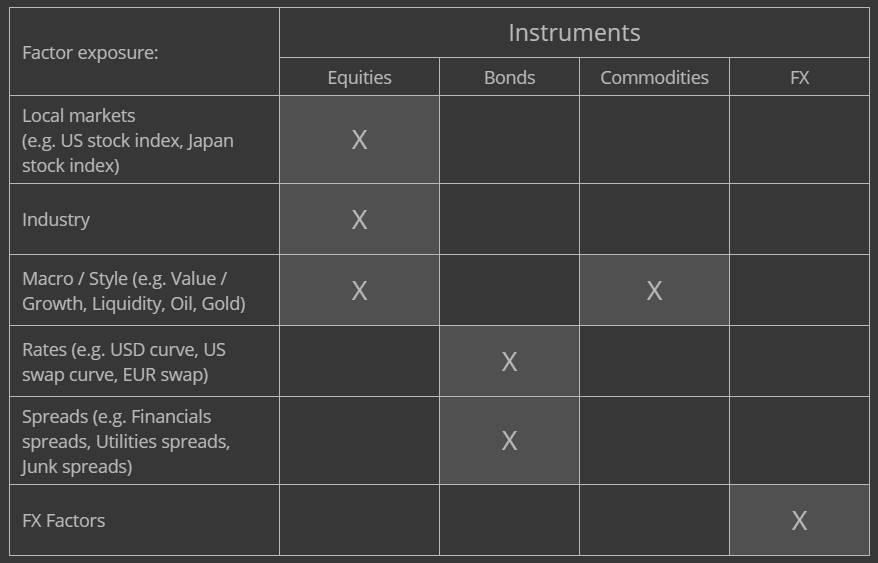

10. Portfolio Crash Test uses a sophisticated factor risk model with over 1,200 factors such as market index, value/growth, size, industry factors, etc. (Image 5)

Image 5: How PCT methodology works with different factor exposures

11. Portfolio Crash Testing is seamlessly integrated with the Finametrica Risk Profiling system, allowing you to quickly crash test your Finametrica stored clients’ portfolios with just a few clicks while completely freeing you from a tedious manual copy-paste routine.

Image 6: PCT RR+Portfolio view

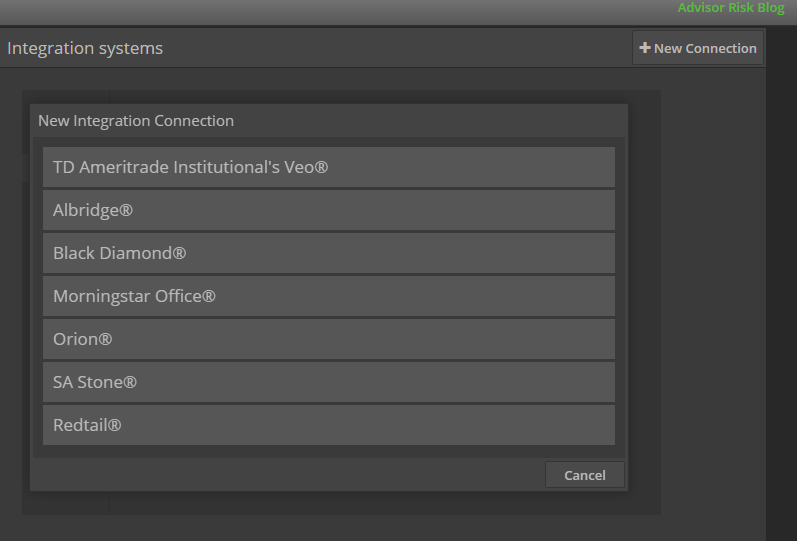

12. Integrations with other widely used portfolio management and financial planning systems, such TD Ameritrade, Orion, Black Diamond, Morningstar Office and others, are also supported. (Image 7)

Image 7: PCT Integration connections

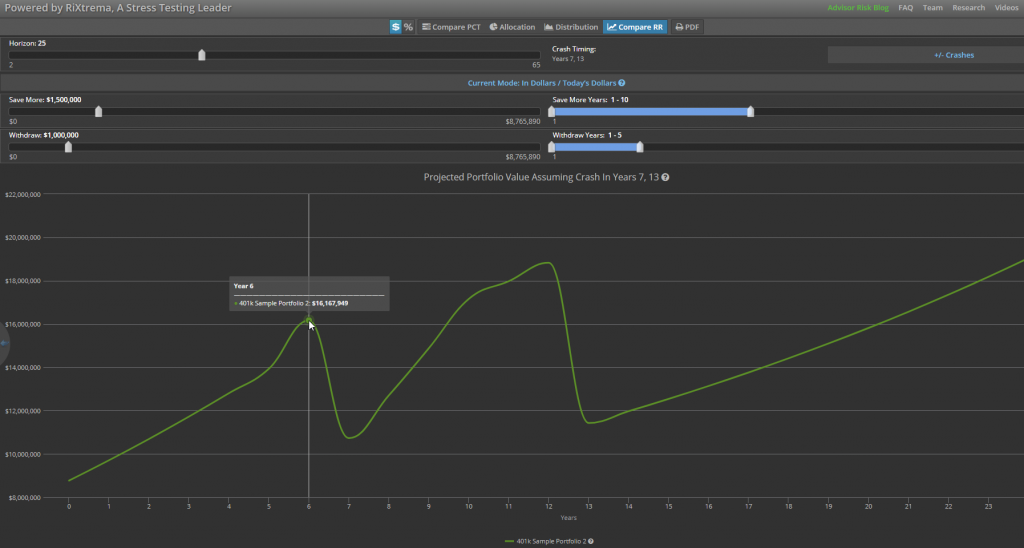

13. The RetireRisk module built in Portfolio Crash Test gives you a profound opportunity to model your portfolios cash flow for up to 65 years horizon. With RetireRisk tool you can flexibly simulate how would portfolio value change over time when affected by crashes, withdrawals, social security and pension income, and other type of events. (Image 8)

Image 8: PCT RetireRisk module

14. Connect the risk that your clients take in the financial markets with their retirement goals in one simple screen. Watch a short video here: Video: Relate To Your Client’s Dreams and Fears

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for July 2018

Pingback : From Client to CEO: Does Portfolio Crash Testing Really Work?

Pingback : What you need to know about the Crash Rating in Portfolio Crash Testing

Pingback : Featured Advisor Interview: How to Relate to Clients & Work with Plan Sponsors?

Pingback : Reasons Why Advisors Should be Using More 401k Fintech Tools

Pingback : To Brexit or Not to Brexit

Pingback : Hard Brexit vs Cool Brexit: How Will Each Impact Your Clients' Portfolios?

Pingback : Case Study: How to Prospect Executives with Risk Assessment Report

Pingback : They are Watching Everything: The Evolution of AI in Public Spaces